Equal access to industry-leading financing

- Business lending reinvented

- Innovative tech-powered platform

- $3.2B direct lender and financing marketplace

Programs

TERM LOAN

If you’re interested in an affordable business term loan with monthly payments (this is not SBA financing), that is fixed-rate, long-term, low documentation, and closes quickly, then you’ve come to the right place.

Loans are fixed for 10 years and can be used for working capital, to consolidate debt (including up to 2 merchant cash advances), buy equipment or inventory, or for expansion and other business needs. Loans are cash-flow based, and the last 12-months of bank statements and the most recent filed business tax return must be provided.

PREQUALIFY- $25,000 to $200,000

- 650 Credit Minimum

- Fixed Interest Rates

- No Hard Collateral Required

- MCA Consolidation

- Streamlined Underwriting

- 2+ Years Time in Business

- Most Industries Considered

- $8,000+ Monthly Revenue Min.

- Close as Fast as 2 Weeks

CREDIT LINE

Market conditions are uncertain, have access to capital when you need it. A revolving business credit line operates like a credit card, usually offering a higher credit limit and lower interest rate, and you pay interest and fees solely on the funds you utilize.

Pay off your balance at any time without incurring penalties and repeatedly draw funds for expansion, emergencies, or any unforeseen business expenses. Credit lines are cash-flow based and in most cases tax returns are not required.

PREQUALIFY- $1,000 to $500,000+

- Affordable Interest Rates

- No Credit Score Minimum

- Up to 36-Month Terms

- 6+ Months Time in Business

- No Collateral Required

- $14,000+ Monthly Revenue Min.

- No Prepayment Penalties

- Nationwide Financing

- Same-Day Funding Available

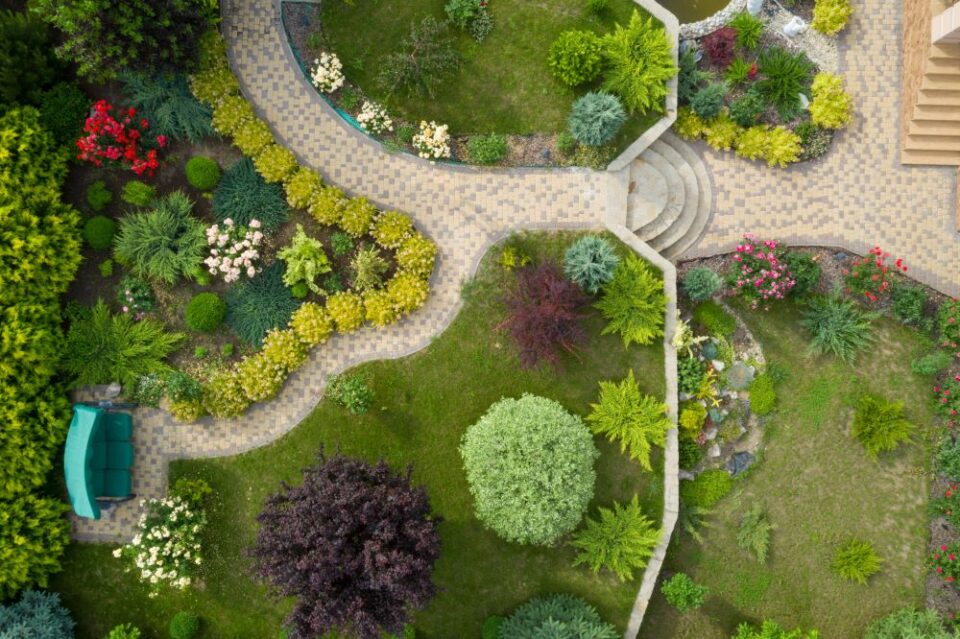

REAL ESTATE

Business owners and property investors can access no income documentation commercial real estate loans, nationwide. This is an asset-based, application-only loan program and no bank statements, tax returns, or financials are required. Most real estate is considered including raw land and residential investment property.

There is no property occupancy requirement, no cash-flow or debt-service minimum, and no third-party appraisal is required in most cases.

PREQUALIFY- $25,000 to $500,000+

- 680 Credit Min. (lower case-by-case)

- Unrestricted Cash-Out

- Nationwide (no population min.)

- Interest Rates From Prime + 2%

- 5 Year Term, 25 Year Amortization

- Application-Only Program

- 50% Maximum LTV

- Raw Land & Rural Property

- Close as Fast as 2 Weeks

EQUIPMENT

Access the nation’s top equipment lenders and tech-powered equipment financing marketplace. Financing is available for most industries and credit profiles, and we’re able to issue approvals in hours, and fund same-day. Use financing to purchase NEW and USED equipment direct from a dealer or vendor, or even from a private party.

Most equipment types are eligible, and you can count on the most competitive terms and a tailored equipment financing structure that works for you. Plus, application-only financing is available up to $350,000.

PREQUALIFY- $30,000 to $5 Million

- Custom Payment Options

- No Set Credit Score Min.

- Finance Rates Starting at 8.5%

- Up to 84-Month Terms

- Dealer & Private Party Sales

- 0% Down on Purchases

- Most Industries Considered

- Same-Day Funding Available

- NEW and USED Equipment

SBA

Business owners can access preferred SBA 7(a) financing up to $5 million for a variety of specialized needs such as to purchase or start a business, or to renovate or construct commercial real estate. SBA Express loans up to $50,000 and expedited SBA 7(a) working capital loans up to $350,000 are also available and can be delivered in as fast as 2 weeks.

Our experience with complex financing structures allows us to deliver creative and flexible solutions when other lenders can’t. Loans are cash-flow based, and personal and business tax returns must be provided.

PREQUALIFY- $20,000 to $5 Million

- Nationwide Financing

- 650 Credit Minimum

- Interest Rates From Prime + 2%

- Startup Financing Available

- Monthly Loan Payments

- Up to 25-Year Loan Terms

- Streamlined Underwriting

- Most Industries Considered

- No Prepay Penalty Options

FAST CAPITAL

Access expedited and automated small business working capital loans and merchant cash advances. One streamlined application enables eligible borrowers to compare multiple financing offers—and funds can be used for any business purpose. Customized payment option with daily, weekly, and monthly repayment terms are available.

Eligible applicants can receive financing approval in only a few hours and funding the same day. We can even consider borrowers turned down by other lenders!

PREQUALIFY- $1,000 to $500,000+

- No Credit Score Minimum

- Competitive Financing Rates

- No Collateral Required

- Streamlined Underwriting

- 6+ Months Time in Business

- $14,000+ Monthly Revenue Min.

- Most Industries Considered

- Nationwide Financing

- Same-Day Funding Available